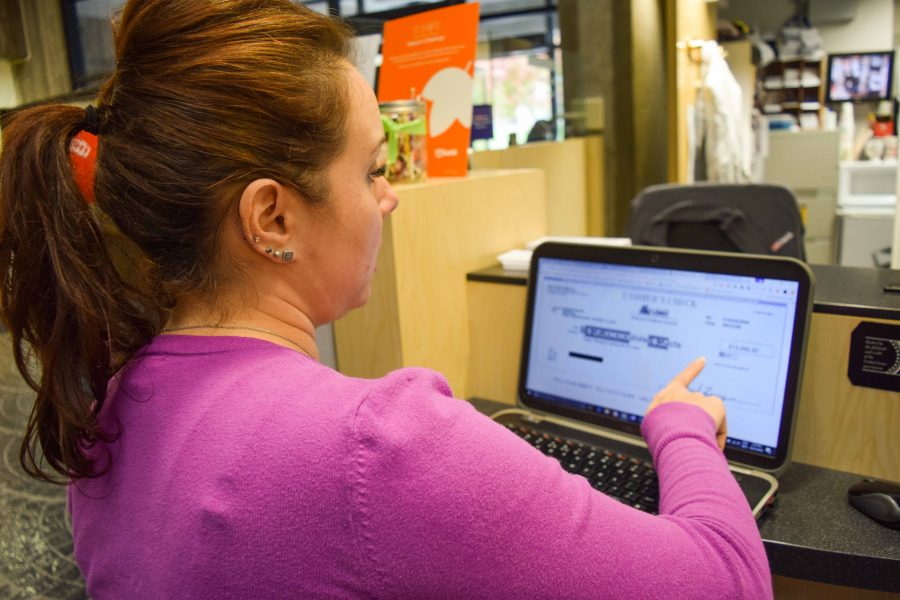

Danielle Moore, the assistant manager of the NKU branch of US Bank hopes students will heed the bank’s warnings about check fraud.

Students fall prey to scammers, check fraud

NKU US Bank sees $30K in check fraud since 2015

October 31, 2016

Danielle Moore has heard NKU students swear to her they would never fall for a scam.

“They say, ‘I’m too smart for that,’” Moore said. “The students say, ‘I would never fall for that.’

“Guess what? Twenty of your fellow classmates fell for it in the last year.”

The assistant manager of the US Bank branch at Northern Kentucky University saw more than $30,000 in check fraud come across her desk in University Center since June 2015.

She’s watched dozens of students wreck their financial future thanks to check fraud, often associated with employment fraud. She said it’s a growing problem that continues to get worse.

“We’ve had parents call and say, ‘My daughter fell for a $1,500 scam in the mail. What do we do?’” Moore said. “Well, it’s going to charge off, and you’re going to owe us money, and we can try to file the dispute and file the police report. We can try to get it on a repayment plan and hopefully you’ll win the dispute and get the money back anyway.

“But who has $3,000 to $4,000 in their pocket to fix this problem?”

Moore is begging students to heed her warnings.

“I wish the students would listen,” Moore said. “We really do. It’s scary. Super scary.”

Targeting students

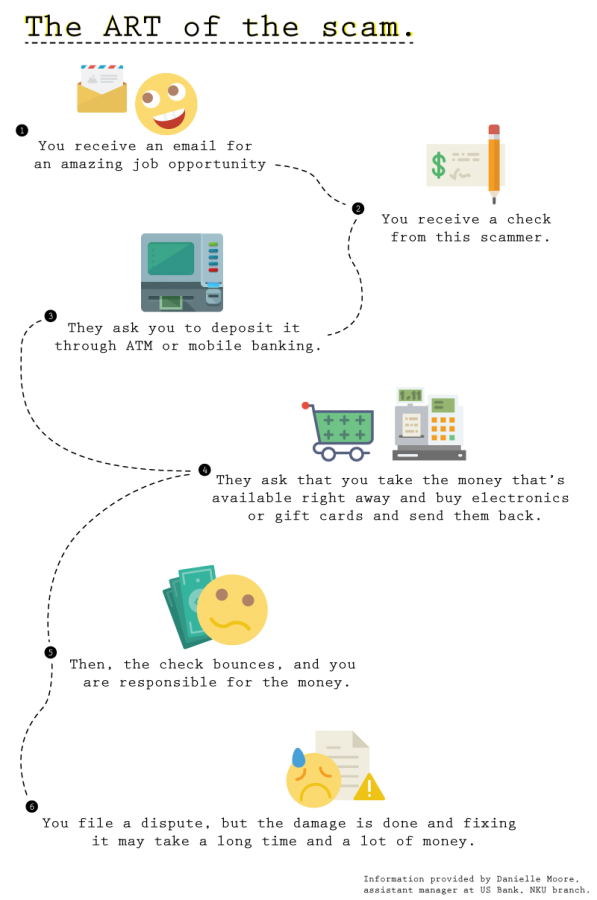

Potential job scams often occur as shown in this infographic (information provided by Danielle Moore, US Bank).

Moore said many students don’t have experience managing their finances. In addition, students are often looking for part-time work that fits into their busy schedules. Moore said it makes them perfect targets for scammers.

“The details are always unique in each circumstance, but it always involves this phony check as a result of unusual working arrangements,” Moore said. “Typically you get a large check upfront – $1,000, $2,500 – before you’ve even worked. You get this money, you deposit the check in your account, you send them a portion of it — or one of the scams was actually to buy electronics with a portion of it.

“Then, send a portion of it or those electronics somewhere, and you keep a small portion of it. That just doesn’t sound right.”

Moore said one of the biggest red flags is the scammers will specify how they want students to deposit the checks – usually through either mobile banking or into ATMs.

“No employer is going to say, ‘We want you to deposit your check with mobile banking’ or ‘I want you to deposit your check with an ATM,’” Moore said. “We want to see the checks. We would love for all the students to bank with us, but that’s not the issue. I want students to feel comfortable to come in and say, ‘I got this check in the mail. I want you to take a look at this.’”

Scammers take advantage of the ability to get some of the deposited check immediately, which allows them to obtain good money from a bad check. This happened in one of the latest scams reported to the bank, Moore said.

“They asked him once the check cleared, which is the next day, most banks will give you $200 available immediately, the rest will clear the next business day,” Moore said. “What’s happening is the scammers are saying, ‘Hey, go buy this computer supply and mail this information here.’ Why would you ever for a business need to mail supplies?

“We’re used to hearing about elderly abuse. This is student abuse.”

A brutal lesson in finance

Many students don’t have a strong foundation of financial skills, which is something Moore would like to see change.

“Students are here for their education, but the financial part, no one has taught them in high school,” Moore said. “No one has taught them in college. They can’t fill out withdraw and deposit slips. I understand that it’s not a college-level class, but this is such a bigger deal.”

Moore said even though these cases are starting to show up in police reports, not enough is being done to help educate students on financial issues.

“That’s awesome, but we’re not talking about it,” Moore said. “We’re not doing anything. I would come talk to any class. That’s what we’re here for – to help.”

Falling victim to fraud is something that can affect students for the rest of their financial future, Moore warns.

“We would love to not have issues and not have losses,” Moore said. “This will follow you. They’re graduating and they’re like, ‘I want to buy a car out of college and I want to do this out of college.’ Guess what? Credit’s screwed. It’s one big fraud scam, and it’s getting worse.”

Career Services can help

Amanda Meeker, assistant director of NKU Career Services, asks students with questions about potential job offers to contact her and her colleagues.

Just because a job shows up in a student’s NKU email inbox, that doesn’t make it a legitimate offer.

Amanda Meeker, the associate director of NKU Career Services, helps students find legitimate opportunities.

“For students, it’s tough, because they get emails from us, they get emails from our legitimate employers, but they also get emails from anyone anywhere,” Meeker said. “It’s tough from an email for a student to discern, did this come from career services? Did this come from somewhere where my email is on a distribution list? Did this come from a robot – a program that is somehow generating these?”

Meeker said students can reach out to Career Services if they receive a job offer that doesn’t seem quite right.

“We encourage any students, if they see something and they aren’t sure, they can forward us the email,” Meeker said. “Sometimes students will bring in their phone or a copy of the email and say, ‘Can you look at this? Are you familiar with this company?’ Through our database, we can often see at least the email domain that companies use.

“A lot of times we can help the student discern, ‘Well, if they’re offering you $50,000 to work from home stuffing envelopes, that doesn’t seem quite right.’

“If it seems too good to be true, it probably is.”

Both Meeker and Moore emphasized that businesses won’t pay you for work you haven’t done. Also, the location of job interviews can also be a red flag.

“No one will ever pay you for work you haven’t done yet,” Meeker said. “Maybe paid training, but still you go to the training and later you get paid. It’s very unusual to have an employment interview that’s not at that place of employment, which you should be able to Google and find. If someone is asking you to do an interview at the library or at a Starbucks, that’s very unusual.”

Meeker agreed with Moore that the education of students is not keeping up with the scammers that students are up against.

“I think year-by-year, these scammers are getting more and more sophisticated,” Meeker said. “Yet, there is not necessarily a place built into the curriculum to teach people about identifying these scams. I’m not sure that the education about how to use the internet is keeping up with how sophisticated these scammers are.”

One thing that makes these job offers seem legitimate to students is they receive the offers in their NKU email.

“I think students think any job that comes to me in my NKU email about a job must be from Career Services. That’s not necessarily true,” Meeker said. “I can look up any student’s email address in the directory online. If you’re not sure if it came from Career Services, bring it down. Email it to us and say, ‘Did you all send this?’

“Also, I want to know about it, so that I can tell students, ‘No, I’ve seen this email and it’s not real.’”

Not just job offers

Scammers are now moving on from employment scams and targeting students in other ways.

“We had a student at Xavier fall for a scam,” Moore said. “She went into the branch manager last Christmas and said, ‘So, I think I did something wrong. They sent me an email saying I got a $7,000 scholarship.’ So this is a new one. The branch manager said, ‘What did you give them?’ She said, ‘My account number, my routing number and my name.’ They got a new account open for her before they could do anything on it.”

Moore said when students receive money they didn’t apply for, they should be immediately suspicious.

“Did she apply for the scholarship? No,” Moore said. “Who is going to send you money if you didn’t apply for the scholarship? If you come to us and you know you just did something you shouldn’t do, we can try and fix it and resolve it. Sometimes it’s too late.”

Police looking into suspicious job offers

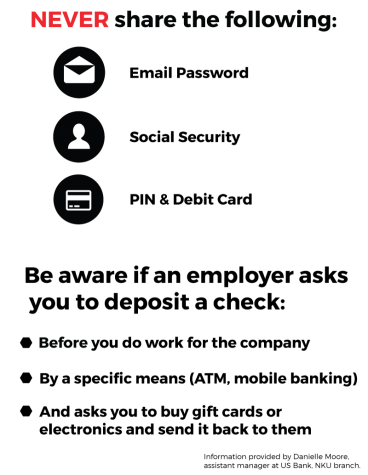

Here are some tips for students to help avoid check fraud (information provided by Danielle Moore, US Bank).

While not every fraud case ends up being reported to NKU police, enough cases have been reported for the department to issue a warning on its Facebook page.

Lieutenant John Gaffin, interim chief of the NKU police department, wants students to reach out to the department if they receive something suspicious.

“We really prefer that they call us,” Gaffin said. “That way we can send somebody out and evaluate it. One of the things that we do is, local police officers have jurisdiction in the county and in the state for certain crimes, but these things almost always cross state lines and even internationally. So what we do is we collect all the information that we can.”

While NKU police may not be able to see a pattern locally for a scam, regional and federal authorities can help identify if it is part of a larger scam operation.

“If somebody physically mailed a check, we’ll call the postal inspector,” Gaffin said. “If it’s strictly internet-based, we’ll call the FBI. We provide them with the information that we have. Sometimes they have a bigger-picture view of it than we do. Sometimes it goes bigger than what we have the limited view of with our resources.”

Gaffin said this is another opportunity to help not only protect students but to educate them as well.

“We thought it was a good time to encourage people to be on guard,” Gaffin said. “Be extra vigilant with this type of specific incident. That’s one of the unique roles we have here on campus is to be educators and teachers, and that was a good teaching point.”

Moore emphasized that while the police can help with these fraud cases, security begins with each individual student.

“You don’t share your email. You don’t share your social security. You don’t share your PIN number,” Moore said. “You don’t give somebody your debit card. It’s opening you up to so much. The only reason we can try to fight it here is because we’re the campus bank here, and I’m seeing the losses come across my desk.

“That’s not other losses within US Bank. That’s not other losses at Fifth Third, or at the credit unions, and everywhere else. It’s way bigger than this. If talking about this is helping, that’s all I can do.”